Don’t get too excited about lower European gas prices

Critically short on LNG import infrastructure, Europe’s ability to ramp up LNG imports is limited.

As we approach the end of 2022, Commodity Insights has analysed the year-to-date data from our LNG Unlocked Platform to forecast our predictions for the year. Since the beginning of 2022, the Russia-Ukraine conflict has dominated the headlines and triggered a surge in energy and commodity prices – some of which were already at all-time highs, prompting many major economies to downgrade their growth outlook in a post-COVID-19 world.

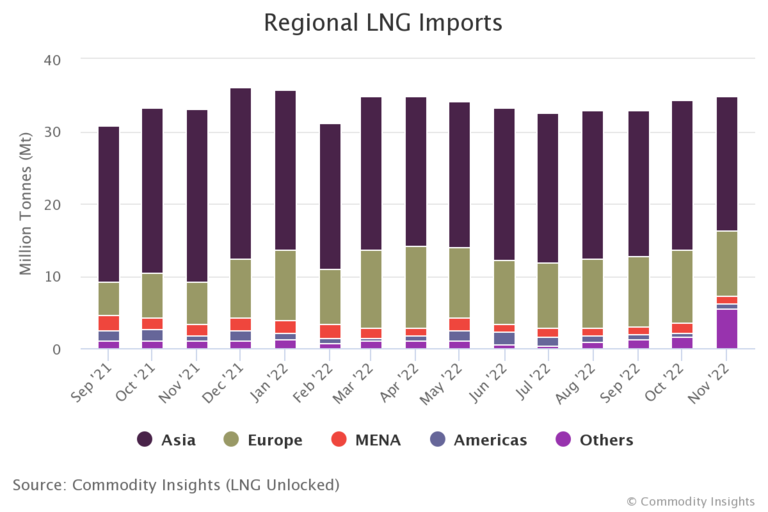

Demand for LNG has been extremely strong at 368Mt in the first 11 months of 2022 (an increase of 10% on the same period of 2021) as Europe has soaked up any latent supply to offset potential shortages from sanctions on Russian pipeline gas. At the same time Asia has reduced its total share of imports by 6% year-on-year as China pivoted away from LNG in favour of cheaper Russian pipeline gas, with the volume switching to Europe. Thermal coal also provided strong competition to LNG in gas, taking some market share as it remained cheaper for power generation in most countries.

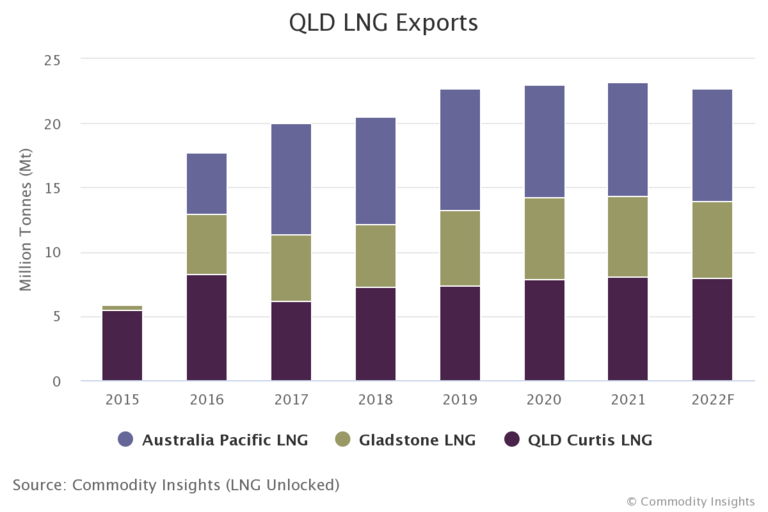

Australia supply has been relatively strong across 2022 with Queensland’s established and reliable LNG export industry supplied by coal seam gas (CSG) fields in the Surat and Bowen basins feeding export infrastructure at Gladstone’s Curtis Island. The three export terminals are the 9 metric tonnes per annum (MTPA), Origin Energy-ConocoPhillips-SINOPEC Australia Pacific LNG, the 7.8MTPA Santos Ltd-led Gladstone LNG, and Shell’s 8.5MTPA Queensland Curtis LNG. Each terminal is predominantly owned or operated as an integrated joint venture, with dedicated pipelines from upstream CSG extraction and processing operations.

Since 2015, when the first of these export terminals were commissioned, Queensland’s total LNG exports have grown from 5.9Mt in 2015 to 23Mt in 2021, at a compound annual growth rate of 25.5%. Based on year-to-date figures, it is expected that 2022 trade volumes will be similar to 2021 levels, but most likely would have been higher if there had not been domestic gas shortages that prompted the Federal Government to implement export limits in early 2022.

According to Geoscience Australia, Queensland’s Bowen and Surat basins have identified CSG reserves totalling 31,588 petajoules (PJ) and a further 21,289 PJ in CSG resources. Based on current LNG export trends, these reserves and resources are sufficient to sustain both a domestic gas and export market for approximately 40 years.

However, LNG markets are relatively embryonic, volatile and heavily disrupted at present. Market players are challenged to find opportunities and mitigate risk amid a supply crunch likely to be exacerbated by the upcoming northern winter, soaring energy prices and the globalisation of gas markets. It has never been more crucial to be equipped with trusted data to navigate complexity and seize opportunities in the LNG market.

Commodity Insights has developed a comprehensive market-tracking analysis portal that covers all aspects of the global supply chain. Current and emerging producers are able to navigate complex LNG markets confidently with the right data and insights, including global trade flows, price outlooks as well as a range of models and charts to support operational and developmental requirements.