Bright future ahead for Australia’s met coal exports

Australia’s economy, regional jobs, and local communities will benefit from growing demand for our world-class steel-making coal driven by population and economic growth in China and India.

The Minerals Council of Australia (MCA) published our report on the demand outlook for metallurgical coal to 2030. This report anticipates demand will grow by over 95Mt from 275Mt 2017 372Mt in 2030 – equivalent to 2.3% growth or around 7.5Mt per annum.

This forecast growth is approximately 56% of current Australian met coal exports, representing a large potential growth opportunity for the sector, presenting a major opportunity for Australia’s world-class coal producers and the Australian economy.

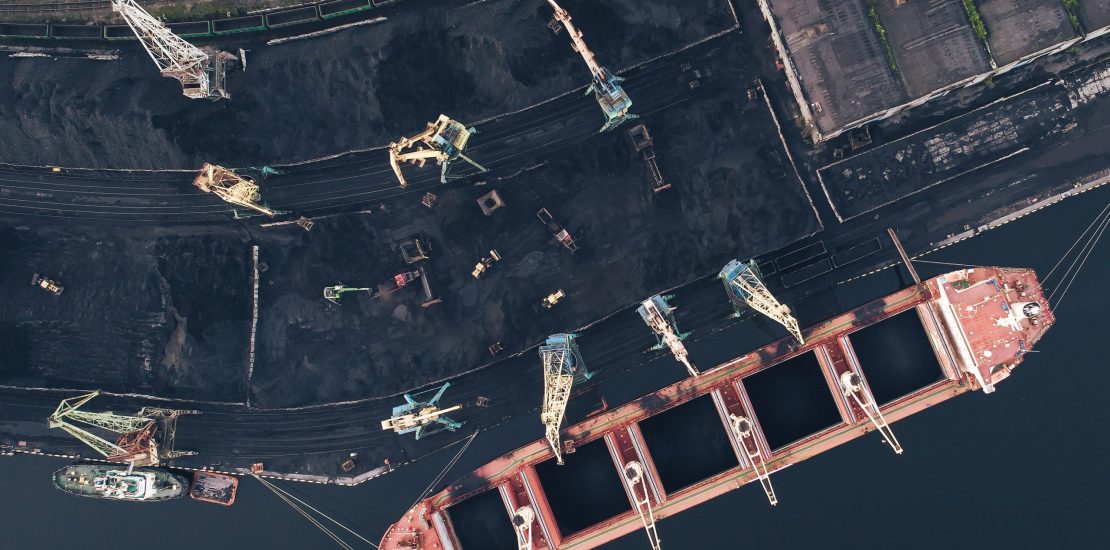

Australian met coal from Queensland’s Bowen Basin is the best steel-making coal globally. In terms of high coal quality, Australia is ideally placed in proximity to key markets in Asia, reliable supply and infrastructure availability, to share in coal demand growth to 2030 and beyond.

This is good news for jobs, regional communities, and Australians, who benefit from our met coal producers’ royalties and company taxes, which fund teachers, nurses, police, and other essential services.

Australia is the largest global exporter of met coal, with our exports growing from 114Mt in 2007 to 147Mt in 2017 in response to strong global demand growth, especially from our largest markets China, India and Japan (which account for about 60% of export volume) along with South Korea, Europe, Brazil and Taiwan.

Australia’s strong position in meeting met coal demand growth cannot be taken for granted. The report notes that given competition from other suppliers, we will need to add or expand mines and infrastructure – particularly rail – in a timely fashion to support this growth.

Drivers of the growth in met coal demand from India and China include the following:

- Solid to strong economic growth in India and ongoing industrialisation and urbanisation drive steel demand.

- Continued solid steel production growth in China.

- Population growth in India and China.

- The inability of domestic met coal production to keep pace with demand in both China and India.

The report also notes that there is no suitable replacement for met coal for making steel because of its critical role in the blast furnace process. It acts as a source of heat, a reducing agent for the iron ore and provides permeability to the blast furnace burden.